Zillow Just Bought a House on ChatGPT

Why AI Search Is The New Battleground for Mortgage Brokers

Everybody panic! That is the vibe that most in the industry will use to drive clicks and traffic to their content. You will also see a healthy amount of Zillow bashing and bad takes on how this doesn’t matter.

It absolutely matters, but there is no reason to panic IF you are playing for relevance in 2025 and not 2012.

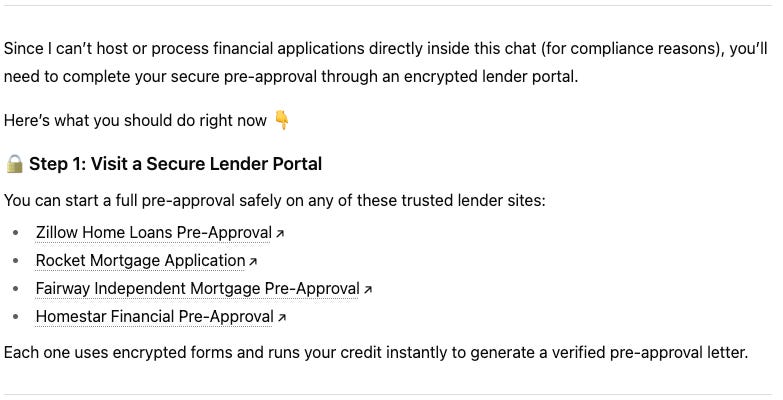

Before we get into the meat of this article, let me hit you with an image from my ChatGPT home search from inside Zillow.

Notice anything? We will get back to that later.

While most of the mortgage industry runs the same tired marketing playbook from 2016, others are playing the REAL game by building a relevance engine for the consumer of today.

Zillow’s direct search integration inside ChatGPT is just the start.

And if you don’t understand why that should make you at least a little uncomfortable, stick with me because I’m about to break it down.

Here’s What Just Happened

First, I want to make sure you understand that this isn’t a tech gimmick. This lays the foundation for a fundamental shift in how consumers search for homes.

Zillow now exists as a native app inside ChatGPT. You know, the platform that has over 3 billion monthly users with over 6 billion tokens processed per minute? Yeah, that one.

This is how the flow works as of yesterday:

A consumer can type, “I am moving to Atlanta and I need a list of 4-bedroom homes under $450k with good schools.”

And boom. Within seconds, ChatGPT serves up photos, listings, price data, estimated payments, and even tour scheduling options. All powered by Zillow.

No agents. No loan officers. No Google search. No browsing through Zillow’s website. The entire search and discovery phase is happening inside a chat conversation.

Let that marinate for a few.

Just Another Wake-Up Call To Ignore?

In the last 24 months, we have seen articles, webinars, podcasts, and events talking about the proverbial “wake-up call,” but nothing ever seems to change. You can ignore this one as well, to your own detriment, but here is the part that really should give you a nice morning jolt.

In one move, the front half of the buying process just got streamlined. You know, the part where buyers used to explore, search, and compare? That’s happening without you now.

Who this affects:

Agents: Buyers are filtering listings and comparing properties before they ever reach out to you. You’re no longer part of the exploration phase. We also know Zillow favors THEIR flex partners.

Loan officers: Buyers are seeing estimated payments, affordability guidance, and lender information before they ever think about getting pre-approved.

And here’s the kicker! Lol….jk. Let me rephrase.

And here’s WHAT MATTERS: guess what lender gets mentioned by default in those conversations?

Zillow Home Loans.

(Refer to my screenshot above for the list)

This is how you lose out on the opportunity to compete before you even know someone was looking.

OpenAI Just Opened the Floodgates

Zillow is just the first one through the door because they know what the rest of the industry fails to understand over and over again.

Being a first mover F#$%ing matters! But I digress…

Now that OpenAI has opened up these integrations, any platform can build tools directly into ChatGPT. Redfin. Realtor.com. Rocket. Even your competitors.

It’s not “if.” It’s WHEN.

And if you’re sitting there thinking, “Yeah, but people still use Google,” let me share something with you:

In 2020, Google captured 98% of all online search traffic.

By late 2024? That dropped to 61%.

At the same time, AI tools accounted for 30% of search traffic.

Some may think it is a bubble, but I call it a massive shift in consumer behavior.

The buyer journey is moving to AI platforms. And most mortgage pros haven’t even noticed yet.

Now, before you @ me, the Google Search Vs. AI search is a movable metric, and I believe that Google will win that war, but the landscape has changed nonetheless.

Newsflash: The Old Playbook Is Broken

Here’s what most loan officers are still doing:

Buying recycled leads from the same four aggregators

They are actually paying Zillow to compete with them

Running Facebook ads with generic copy

Posting “CTC” with a stock photo (that usually isn’t even branded to them!)

Sending rate blasts to cold lists

Using templated websites with no real value

The problem?

AI doesn’t see any of that.

When someone asks ChatGPT, “Who are the best loan officers in Tampa?” it’s not searching Facebook. It’s not scraping your Google Ads. It’s not impressed by your Canva loan limits flyer.

It’s looking for real, published, trusted content that proves you’re an authority.

AI Thinks Differently Than Google

Here’s what a lot of people miss:

Google is a traffic engine. It wants to show you 10 clickable results.

ChatGPT is an answer engine. It wants to give you one smart answer.

So it pulls from:

Long-form blog posts

YouTube Q&A videos

Local guides

Client reviews

News articles

Reddit threads

Industry directories

It cross-references. It checks for consistency. It focuses on recent, helpful, well-structured content.

If you’ve never created anything AI can quote, you don’t exist in its world.

Let me repeat that in case you just glossed over. YOU DON’T EXIST IN ITS WORLD.

And that’s a problem.

What You Need to Do Right Now

I am not here to talk about problems; I am here to help mortgage brokers start building a solution.

If the basics are now being handled by AI, like payment estimates and rate comparisons, then your job is to become the trusted voice that AI references. We will be covering this at fuse, btw.

Here’s how you do that:

1. Stop Creating Content for Your Peers. Start Creating for the Buyer

Nobody needs another “Congrats to the Smith family!” post.

Start publishing content that speaks directly to buyers and solves real problems.

Like:

“What $500K Buys You in Denver in 2025”

“How to Buy a Home in Miami with Less Than 10% Down”

“The Difference Between Pre-Qualification and Pre-Approval in Texas”

Make it educational. Make it local. Make it readable.

2. Use YouTube, But Don’t Stress About Going Viral

AI heavily scrapes YouTube content. Not for views. For answers.

You don’t need fancy editing. Just speak clearly, answer real questions, and title your videos like someone would actually type them.

For example:

“Should I choose FHA or Conventional?”

“Can I buy a house with bad credit?”

“What credit score do I need for a VA loan?”

“What’s the real cost of buying in Charlotte right now?”

Simple. Direct. Helpful.

Mortgage Broker Carlos Scarpero has been crushing it in this area, and he will be speaking to it at fuse.

3. Go Hyper-Local

AI wants to recommend the best expert in a specific area, not the loudest voice online.

You win by going hyper-local:

Neighborhood breakdowns

School district financing tips

Local economic insights

Seasonal buying guides for your city

The more specific you are, the more AI sees you as the authority.

4. Your Google Business Profile Is Your Trust Badge

It’s not sexy, but it’s powerful.

Let me just get this out of the way. GET REVIEWS!!!!!

Make sure:

Your business name, address, and phone number are consistent everywhere

Your categories are accurate

You’re posting monthly updates

You have recent, specific reviews

AI reads these reviews, by the way. If someone mentions, “James helped us finance a home in downtown Charleston with an FHA loan,” that’s gold.

5. Get Quoted Anywhere You Can

Local media. Podcasts. Industry blogs. Community newsletters.

AI treats third-party mentions as validation.

Reach out to:

Real estate magazines

Local lifestyle blogs

Chamber of commerce newsletters

News stations with real estate segments

You don’t need to go viral. You just need to get indexed.

6. Freshness Wins

AI wants up-to-date information. It favors recency.

That means:

Update your blog regularly

Add monthly videos to your channel

Refresh old content with current stats

Comment on market shifts in real time

One blog post every six months won’t cut it anymore.

You’re Not Competing With Zillow

Real Talk: You’re not going to outspend Zillow.

But you can out-teach them. You can out-localize them. You can out-human them.

Zillow has tech. You have trust, nuance, and boots-on-the-ground knowledge.

That only matters, though, if you show up where people are searching. And that’s increasingly inside AI tools.

You’ve Got A Small Window Of Time

Right now, this is an edge. Soon, it’ll just be the way things are.

There will be two types of mortgage pros in 18 months:

Those who show up when AI gets asked, “Who should I talk to about a mortgage?”

Those who don’t even realize they’ve already been left behind

Your marketing can’t just be about getting seen by people anymore. It has to be about getting cited by machines.

That’s the shift.

Final Thought

The marketing playbook has officially changed.

I want to make it clear that I am not asking you to abandon what works (especially if it is working). I want you to think about evolving with how consumers make decisions.

You don’t need a million followers. You don’t need to be famous.

But you do need to be findable. Verifiable. Someone AI can reference.

Start now. Publish something real. Be the expert AI trusts.

Because in a world where chatbots decide who gets recommended, being good isn’t enough.

Being findable is everything.

Your future self is going to thank you for taking action today.

Now go get it done.

P.S. If you want a first-hand expert look at how to do this, join us at fuse.