The Credit Wars Are Here: What Mortgage Brokers Need to Know

Joy Huska gives us a dose of real talk about the credit industry

There ain’t no sugarcoating it. The credit reporting space is as messy as it has ever been. If you’ve been in the mortgage game long enough, you already know that chaos is part of the job. But the kind of confusion we’re seeing right now around credit scoring models, pricing changes, and workflow shifts? It’s next-level chaos.

That’s why I pulled in Joy Huska, a true expert in the credit space, join me for a special webinar last week to cut through the noise and break down what’s really happening. Whether you’re a broker, LO, or ops lead, this article is your field guide to the credit wars, FICO vs VantageScore, exploding credit report costs, and what’s headed our way in 2026.

Let’s get into it.

The Credit Wars: What’s Really Happening

Let’s start with the basics. We’re in the middle of what Joy called the “credit wars.” It’s not hyperbole, it’s the reality.

On one side, we’ve got FICO, the 75-year-old stalwart we’ve all been relying on for underwriting decisions via DU and LP since 1995.

On the other, we’ve got VantageScore, created by the three major credit bureaus (Equifax, TransUnion, and Experian) in the early 2000s. They’ve been slowly gaining traction, and the newest model, VantageScore 4.0, is creating waves.

Here’s what you need to know:

FICO and VantageScore use different algorithms and score different behaviors differently

At least 40 million consumers could benefit from the VantageScore 4.0 model

VantageScore 4.0 is already approved by the GSEs (Fannie/Freddie) but isn’t yet in use for underwriting

So yes…the war is real. And it’s going to shape how you pull credit, price loans, and talk to clients moving forward.

FICO’s Bold Move: Going Direct?

If your eyebrows raised over the recent announcement that FICO might go direct and cut out the credit bureaus, you’re not alone. It came out of left field… but what does it actually mean?

Short version: it’s unclear. Even Joy, who’s neck-deep backstage in credit discussions, said there’s “no clear picture” yet.

Here’s what we do know:

FICO is increasing pricing to the bureaus

That cost will inevitably get passed down to brokers, lenders, and ultimately borrowers

FICO still doesn’t have the infrastructure to replace the full CRA function

Translation: even if FICO wants to go direct, they’ll still have to rely on CRAs to bundle and deliver data in a usable, compliant way.

Bottom line for LOs? Keep an eye on the headlines, but don’t stress it day-to-day. These changes won’t truly impact your workflow until mid to late 2026 at the earliest.

VantageScore 4.0: Hype vs Reality

VantageScore 4.0 made a splash when Experian announced they’ll offer it “indefinitely,” and yes, it’s approved. But no, that doesn’t mean it’s in use yet.

Let’s clear it up:

Status: Approved, but not integrated with DU/LP/pricing engines yet

Timeline: Earliest rollout is estimated to be mid-2026

Impact: Could help ~40 million consumers with thin credit files

There’s potential here…huge potential, especially for younger or credit-thin borrowers. But just like with FICO’s shift, it’s not something you can use today for loan decisions. Until it’s integrated with AUS systems, MI pricing, and investor guidelines, it’s a data-only tool.

Keep it on your radar. That’s all, for now.

Why Credit Reports Are So Damn Expensive Now

Let’s talk about what EVERYONE has been talking about. Credit report costs. If you’ve been wondering why your credit report costs have skyrocketed, the next line will give you an idea.

Since 2019, the cost of a credit report has gone up 3,200%. Yeah. That’s not a typo.

Here’s why:

The Triple Threat:

Model Competition

- FICO Classic, FICO 10T, VantageScore 4.0… all jockeying for relevanceInfrastructure Complexity

- Each model must integrate with DU, LP, MI, LOS platforms, and investor guidelinesRegulatory Requirements

- New compliance rules = more technical lift, more cost

Add to that the rise in fraud detection tools, data layers, and middleware platforms, and you’ve got a situation where even a “simple” credit pull involves serious backend complexity.

And guess what? That cost rolls downhill. From FICO to the bureaus, to the CRAs, and finally to you and your borrower.

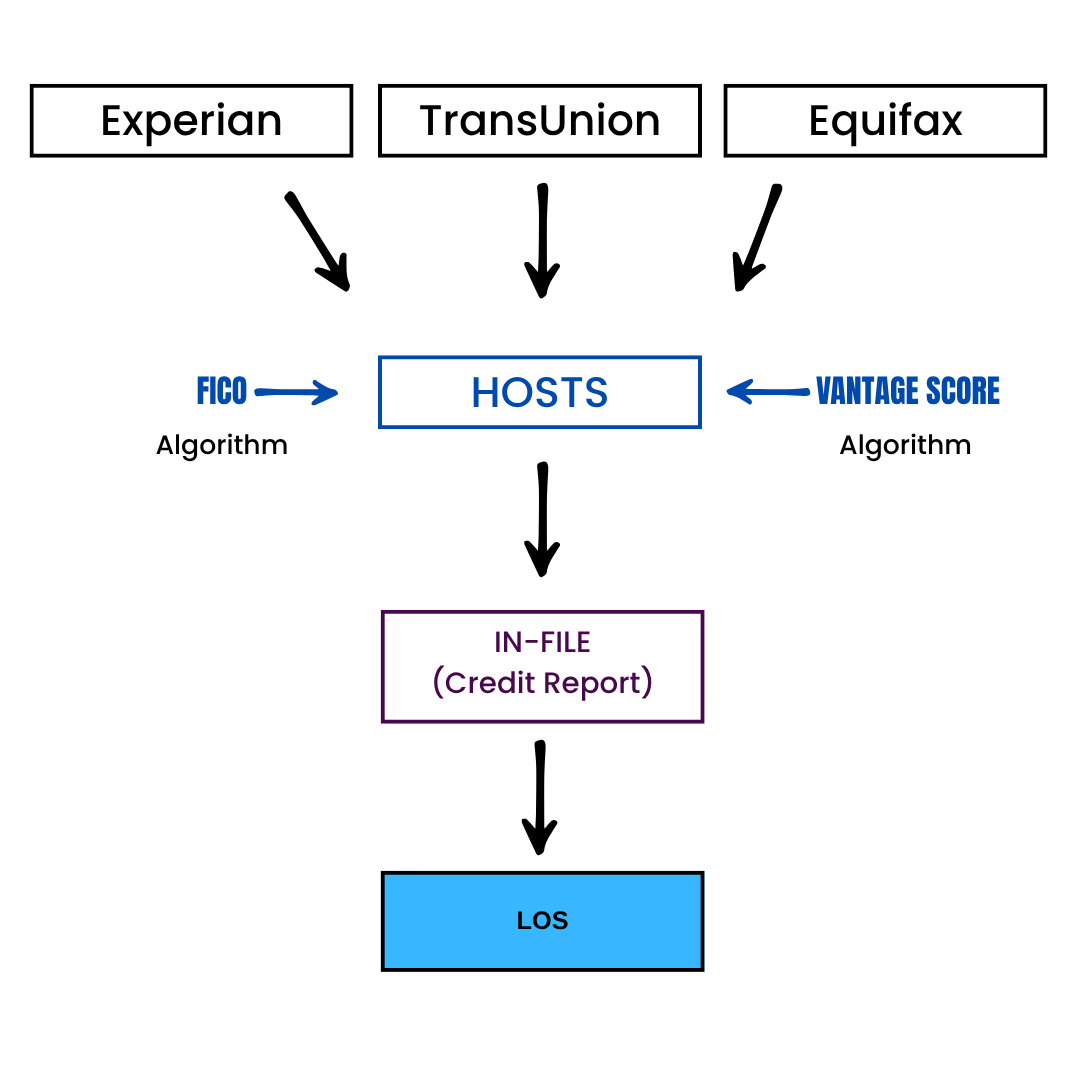

How the Credit Report Flow Actually Works

You press a button. A credit report pops up. Simple, right?

Not even close.

Here’s a very simplified version of the data flow:

So when you hit that “order credit” button, your CRA is doing the heavy lifting, merging the data, applying the scoring model, checking for fraud indicators, and delivering it back in a way that DU, LP, and your pricing engine can read.

What CRAs Actually Do (And Why It Matters)

CRAs aren’t just middlemen. They’re your silent partner in credit reporting, compliance, and strategy.

Here’s what the good ones (like Joy’s team) actually handle:

Quality control and error resolution

Compliance tracking (e.g., written consent, permissible purpose)

Fraud detection and UDM alerts

LOS and pricing engine integrations

Strategy tools like hybrid reports and soft pulls

Not all CRAs are created equal. If yours treats you like a number, you may want to explore alternatives.

Smarter Credit Strategies for 2025–2026

One of the smartest plays right now is running hybrid credit reports instead of defaulting to hard pulls.

Hybrid Credit Report Benefits:

No trigger leads

No impact on score

Fully underwriteable

Doesn’t show up on UDM monitoring

Inexpensive (as low as $5)

Optional “no score” or “with score” versions

For purchase prequals, refis, and low-intent leads, this approach gives you insight without creating friction. Then, when the client is serious? Upgrade to a full report.

The Wrap: How to Stay Ahead

There’s a lot of noise out there…FICO announcements, VantageScore rollouts, pricing changes. But here’s what really matters:

What You Should Focus On

Understand the changes coming with credit scoring models in 2026

Watch for rollout timelines on VantageScore 4.0 and FICO 10T

Track how your credit report costs are affecting margins

Explore smarter tools like hybrid reports to lower costs and increase control

Partner with a CRA that treats you like a client, not a user ID

If you’re working hard to close loans in today’s environment, the last thing you need is more uncertainty. The good news is now you know what’s coming, and you’ve got options.

Want to dig deeper into strategies like hybrid reports, non-traditional credit, and CRA customization? Joy and her team are happy to walk you through it. You’ll find her at upcoming events like FUSE or just visit mycreditinfo.com to learn more.