Darren Copeland’s “All-In” Strategy: How Mortgage Brokers Stay Relevant, Competitive, and Profitable in 2026

The mortgage world is changing. Again.

And if you’re still showing up to your business the way you did in 2019 or even 2023, you’re in trouble. The middle ground is disappearing. You’re either all-in and dominating your market… or you’re slowly slipping into irrelevance.

We recently had Darren “DC” Copeland, founder of Summit Lending and one of the most respected voices in the mortgage space, join us on The MLO Project. The insights that came out of that episode were great, real, and essential for growth.

If you’re serious about building a SUCCESSFUL mortgage business strategy for 2026, this article is your guide.

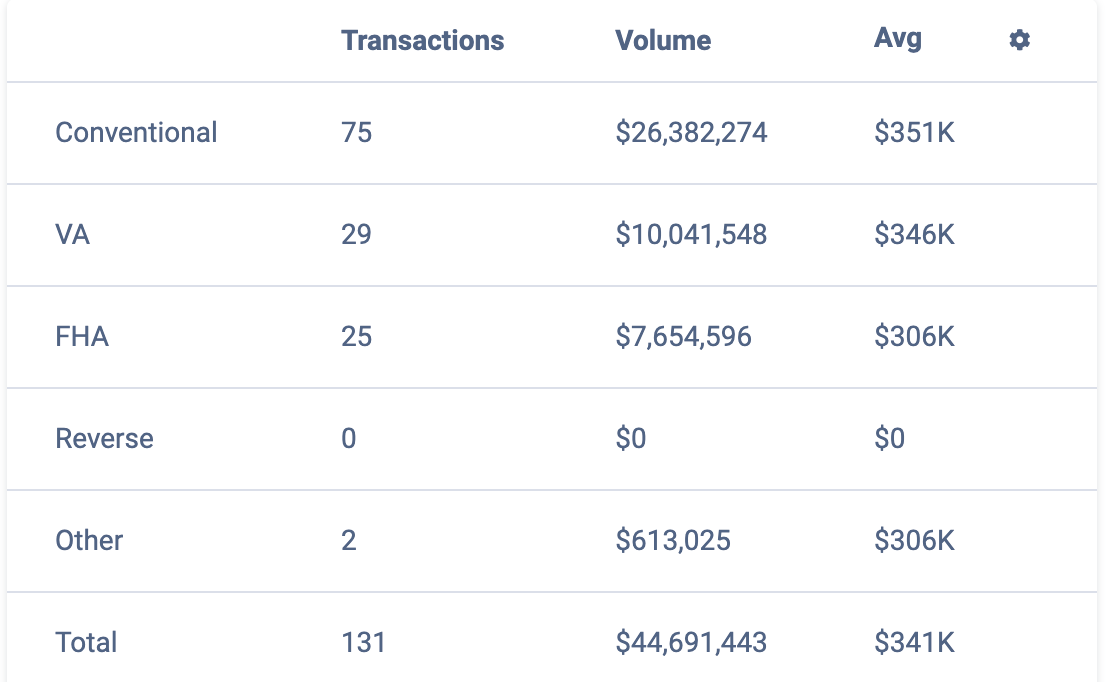

Now, before I get into the spice, I know very well that loan officers are very careful who they listen to, so I have saved you all the trouble of doing the production search and put DC’s RETR stats below.

The Middle Class of Mortgage is Disappearing

Let’s get something straight right now: the middle class of mortgage is evaporating.

You’re either:

Building brand,

Scaling visibility,

Leveraging tech,

And deepening relationships

Or you’re stuck chasing rate shoppers, doing two deals a month, and hoping this market turns around.

It won’t, at least not in the way you’re used to.

“It’s time to get real with yourself,” says DC. “You’re either serious about building a modern, scalable mortgage business or you’re playing house with your career.”

Coachability is the #1 Differentiator

One of the “real talk” moments in the episode came when DC said this:

“Only 10% of LOs are actually coachable. The other 90% just wander aimlessly without a plan.”

That’s not shade, that’s experience talking.

The takeaway? The most successful loan officers aren’t necessarily the smartest, most technical, or best on camera. They’re the ones who:

Have a plan

Stay consistent

Execute over and over again

If you want to elevate your business strategy in 2026, step one is being willing to listen, learn, and implement.

It’s Time to Get Serious About Time

Let’s talk about your calendar. Or lack thereof.

Real talk time! Time management IS the foundation of your revenue. DC broke this down clearly:

Stop confusing busy work (reading guidelines, 4-hour webinars) with green zone work (calls, videos, follow-ups, referrals).

Track your actual marketing hours per week.

Live in the green zone at least 2 hours a day.

“If you don’t control your calendar, your business controls you, and that’s not a long-term play,” DC added.

Your CRM Isn’t Optional Anymore

We’ll say it louder for the people in the back:

Your CRM is now your #1 asset.

It’s not a “nice to have.” It’s not an “I’ll get to it later.”

The recent Trigger Lead legislation only underscores this truth: data wins.

What should your CRM do for you?

Track every client and referral partner touchpoint

Automate follow-ups

House reviews, testimonials, and video content

Drive your marketing workflows

Integrate with AI tools

If you don’t have a CRM that works (Empower, anyone?), you’re giving business away. Daily.

Visibility = Credibility = Opportunity

DC told a story that should wake you up about AI:

“A 27-year-old couple came to us last week. We asked how they found us. They said they typed ‘best mortgage broker Kansas City’ into ChatGPT. And we showed up. Because of our content, videos, and 400+ Google reviews.”

That’s the future! Well…no. It is actually that’s the present.

If you think borrowers are calling Aunt Linda the Realtor first, you’re already behind.

Here’s how consumers are choosing loan officers in 2025:

Ask AI

Watch your YouTube or IG content

Check your reviews

Book a call

You don’t need to be a TikTok star, but you do need to show up.

Choose Your Content Weapons

You can’t dominate every platform, but you can go all-in on one or two.

Top-performing LOs in 2025 are doing things like:

Sending weekly gratitude videos to partners and past clients

Publishing 2–4 YouTube videos per month

Creating monthly newsletters (That Matter)

Running educational webinars or podcast guest spots

Posting market insight content on LinkedIn or Instagram

Want the real flex? Pair this with AI for outlines, captions, scripts, and edits.

Consistency + leverage = visibility.

Agent Relationships Are Shifting (And That’s a Good Thing)

Let’s address the elephant in the room: agents are not the only source of leads anymore.

Consumers are going direct. They’re:

Running their own numbers

Searching content

Using AI

Making decisions before they ever talk to a human

That said, great agents are still powerful allies, especially when you shift the conversation.

Talk about:

Your marketing systems

How you generate buyer leads

What AI tools you’re using

How you’re improving pre-approvals and conversion rates

“Position yourself as a business partner, not a vendor,” DC emphasized.

The Next 12–18 Months Are Everything

Here’s the deal: you’ve got a 12–18 month window to decide who you’re going to be in this industry.

You can either:

Build systems & processes

Automate follow-ups

Refine your messaging

Use AI to scale

Grow your local and digital footprint

Or…

You’ll be playing catch-up in 2026 when everyone else is already winning.

“You’ve got to be disciplined and relentless,” DC said. “Don’t wait for the market. Make your move now.”

The Wrap: The Formula Is Simple (But Not Easy)

We’ll leave you with the 3-part playbook for any loan officer looking to stay relevant and win in 2025:

Plan: Build a real 90-day strategy around visibility, relationships, and content

Protect your time: Block off your green zone hours like your business depends on it (because it does)

Execute: Don’t overthink. Post the video. Make the call. Launch the campaign.

“We’re not talking about a knowing problem, we’re talking about a doing problem. You know what to do, now go #$%&ing do it.”

Want to Go Deeper?

Grab a copy of The Green Zone Project, a practical, no-fluff guide to getting real results in your mortgage business (written by Darren Copeland and yours truly).